Sunday, August 02, 2015

Having dipped below $50 a barrel for the first time in 6 months

to a meek $49.85, crude oil prices have dipped well into bear market territory. But this comes as little surprise given the $20+ skid witnessed

throughout July, due to a number of combined factors.

Having dipped below $50 a barrel for the first time in 6 months

to a meek $49.85, crude oil prices have dipped well into bear market territory. But this comes as little surprise given the $20+ skid witnessed

throughout July, due to a number of combined factors.

As a commodity, you could assume supply is currently stripping demand. This is mostly thanks to record US production and subsequent foreign competition cranking up output. Paradoxically, the production boom forces the big oil producers to cut jobs. So as they ratchet up drilling and are consequently in need of more workers, they have fewer laborers to do the work.

Additional sources dragging down the market include the fracking boom and the fact Iran still produces 2.7 million barrels every day, of which 1 million are exported. Investors are also speculating Iran has a massive stockpile of somewhere to the of 30 million barrels, with which they could flood the market the day sanctions are lifted.

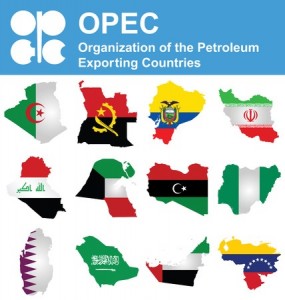

Additionally, fracking is not only breathing new life into US oil drilling, but also supplementing massive OPECs such as Saudi Arabia. Implemented as a new avenue for harvesting oil and an added revenue stream, fracking is making the already oil-rich nation much more oil-rich.

With new oil rigs opening every week and futures indicating $45.31 a barrel in September, there is no apparent relief for oil traders anytime soon. With China, India and Russia not about to relinquish any gained ground in the market, along with US rig production up for the third time in the last four weeks, the market continues to flood with sweet, light crude.

TAGGED AS:

- crude production

- oil output

- oil production

- why gas prices are low